- Monarch

- Posts

- I BOUGHT A STOCK

I BOUGHT A STOCK

(read this to see which one and WHY)

Hey there 👀

Welcome back to Monarch 👑

Bailey here, back & better than ever (???) with some electrifying stock market info about my latest purchase. 🔌

Keep scrolling for deets!!!!!

But don’t you want to know why I’m feeling ELECTRIC?!

Because, well, I just purchased stock in a company founded by THIS GUY:

If he looks familiar, but you can’t quite put your finger on it, I’ll sauce a hint:

Yep - GE actually stands for “Good ol’ Edison”! (No it doesn’t)

It’s important to note that GE’s cofounder & first president, Charles Coffin, also played a huge part in the company’s success. You can learn a bit more about him here.

GE’s Dating Profile 🔥

Who: General Electric Co. (GE) & its 58,000 employees

What: A technology and financial services company that operates in the Power, Renewable Energy, Aviation, and Capital sectors.

When: Founded in 1892 by LITERALLY Thomas Edison lmao

Where: HQ in Boston (with satellite offices in places like Detroit!)

Why: GE is like the the business world’s avatar:

Image Source (Content Source is GE.com)

Last fun piece of GE information before looking at why I grabbed some slices of GE’s pie for myself 🥧

Look at this sick interactive timeline of their notable inventions/innovations:

🚀Why I Bought GE Yesterday🚀

Reason 1: High Composite Rating

Composite rating: GE has an IBD Composite Rating of 94, which is a high overall rating based on various financial metrics.

Make it make sense: It's like a grade in school. The higher the number, the smarter the investment. And a 94? In this market?! That's an A right there!

Main contributor: 🛫📡👽🚀

GE aerospace is hot sh*t: They make jet engines and aviation systems for plane makers (including huge names like Boeing).

They also run a high-margin business for engine repair and maintenance.

In short, GE’s aerospace segment is booming with business and has even been termed its "crown jewel.” 👑

This all shows GE has quite a strong portfolio to its name, considering most of us think “GE” and think “💡”.

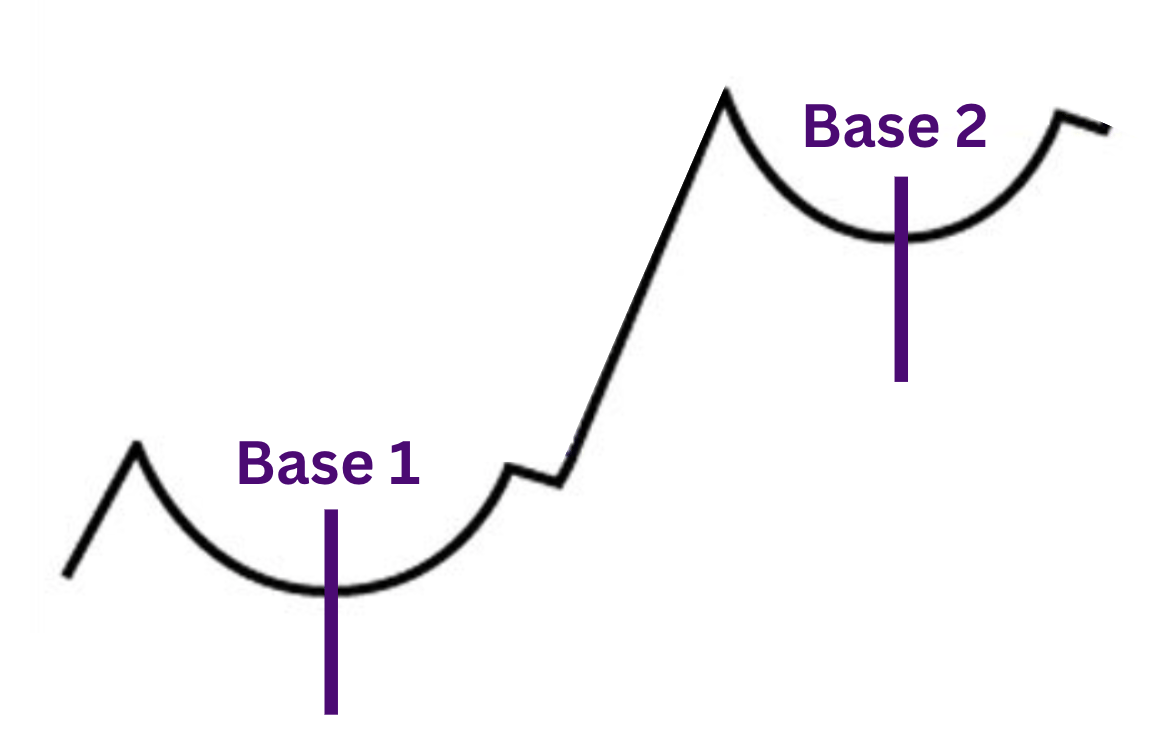

Reason 2: Solid Base Formation

Solid Base Formation: GE stock is forming a flat base with an ideal buy point of 117.96, as per MarketSmith analysis.

Make it make sense: GE is in a sweet spot right now, where the price is stable and it's a good time to buy before a potential leap.

Reason 2.5: Second-Stage Base

Hopping off that ‘potential leap’ comment, we have some analysts saying we’re entering a second stage.

Second-stage base: If a stock is properly identified at the base of a second stage, the probability of higher investor gains shoots up.

Make it make sense: Imagine a triathlon competitor completed the swimming portion of the event, took things a little slow for a few minutes as she transitioned out of the water, and then took off cycling like a madwoman. The base part of this analogy is when she was slow getting out of the water - buy during this time, in hopes she’s going to take off fast on cycling!

Visual example of first and second bases (*which can greatly vary!):

I made this

Where I’m hoping I’ve caught GE based on the stock analysis:

I made this

Based on Stage 2 free cash flow to equity, GE’s estimated fair share value is $154, which means its current general value is being undervalued by 27% at it’s current share price of $112. If the second stage swing up holds true, the current share price should be swingin’ on up!

Viewing Potential Risks:

Possible Fluctuation in Widespread Travel

Slowing air travel trends: Analysts warn that there might be reduced demand in the aerospace sector. (more context) (more context #2)

Make it make sense: Planes might be sitting on the tarmac a bit more often. Fewer flights = fewer repairs = less business for GE's aerospace division.

The good news: Morgan Stanley highlighted GE as a solid, household industry name - but also warned of this risk on Aug 11.

Continued (potential) Earnings Pressure

Earnings Pressure: At the moment, GE's earnings are its Achilles' heel (or as close as it is to one at the moment) with an EPS Rating of 76 out of 99.

Make it make sense: The company's not making as much money as we'd like it to. But hey, we're all works in progress, right?

The good news:

GE’s Full year earnings are expected to rise by 20% in 2023 and 83% in 2024, which shows a lot of promise BUT needs to be carefully watched.

So yeah - if you’re stock-market-single & ready to mingle, I hope this information helps you in the pursuit of your next stock bae (sorry).

If you're boo’d up, ie not looking to make any investments/are new in the field, maybe wait and see if GE maintains its current mojo!

This is the first buy I’ve made since we started writing Monarch last month, so I’ll keep you updated on its performance as we chug along 🚉 🎫

Happy investing, and more importantly, HAPPY FALL BABY YES 🍁

Bailey

Sources:

Forbes: General Electric

Yahoo Finance: Investors Undervaluing GE by 27%?

GE: GE History